Strategies for Cost-Effective Offshore Company Development

When taking into consideration overseas business formation, the pursuit for cost-effectiveness ends up being a vital problem for services seeking to expand their procedures worldwide. In a landscape where monetary carefulness rules supreme, the strategies employed in structuring overseas entities can make all the distinction in achieving financial effectiveness and functional success. From browsing the intricacies of territory selection to applying tax-efficient frameworks, the journey towards developing an overseas visibility is raging with obstacles and chances. By checking out nuanced methods that blend lawful conformity, financial optimization, and technical developments, companies can begin on a course in the direction of offshore business development that is both economically prudent and purposefully noise.

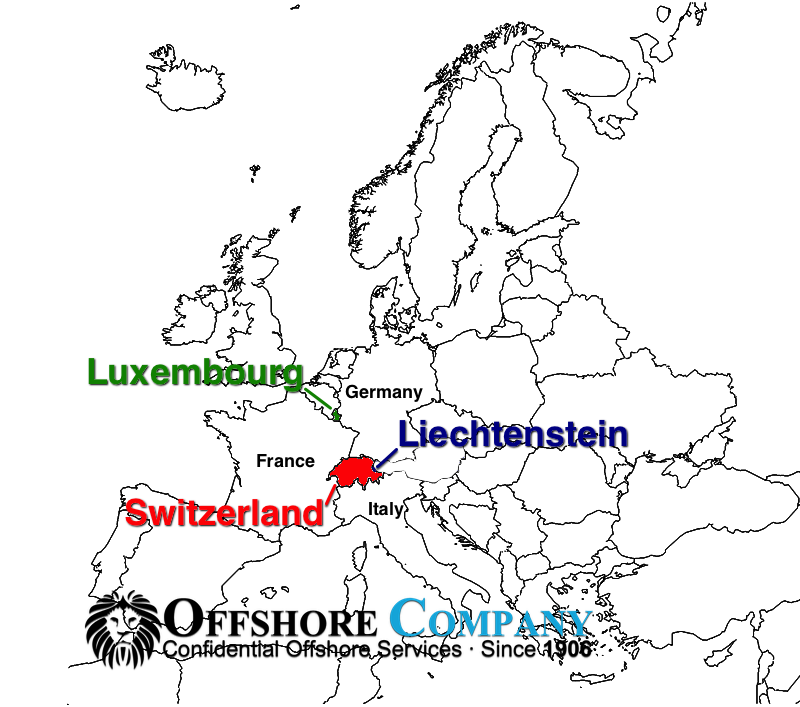

Picking the Right Jurisdiction

When establishing an offshore company, selecting the ideal territory is a crucial choice that can considerably impact the success and cost-effectiveness of the development process. The territory picked will identify the regulatory structure within which the business operates, impacting tax, reporting requirements, privacy laws, and general service flexibility.

When choosing a jurisdiction for your offshore firm, several aspects must be considered to make certain the decision aligns with your calculated objectives. One critical element is the tax routine of the territory, as it can have a substantial influence on the company's productivity. In addition, the level of governing conformity required, the financial and political stability of the territory, and the convenience of doing organization has to all be assessed.

Moreover, the online reputation of the jurisdiction in the worldwide company community is important, as it can affect the assumption of your business by clients, companions, and monetary institutions - offshore company formation. By meticulously examining these elements and looking for professional advice, you can choose the best territory for your offshore company that maximizes cost-effectiveness and supports your company objectives

Structuring Your Company Successfully

To make certain optimum performance in structuring your overseas firm, thorough interest needs to be provided to the organizational framework. The very first step is to specify the business's possession framework plainly. This includes figuring out the police officers, directors, and investors, as well as their responsibilities and roles. By establishing a transparent ownership structure, you can make certain smooth decision-making procedures and clear lines of authority within the company.

Following, it is vital to take into consideration the tax ramifications of the chosen framework. Different jurisdictions provide differing tax advantages and rewards for offshore firms. By meticulously assessing the tax obligation legislations and regulations of the selected jurisdiction, you can optimize your firm's tax performance and lessen unnecessary costs.

In addition, keeping correct paperwork and documents is important for the efficient structuring of your offshore company. By keeping updated and accurate records of monetary purchases, company decisions, and compliance documents, you can make sure transparency and accountability why not try these out within the organization. This not only facilitates smooth procedures yet additionally aids in demonstrating compliance with governing needs.

Leveraging Innovation for Financial Savings

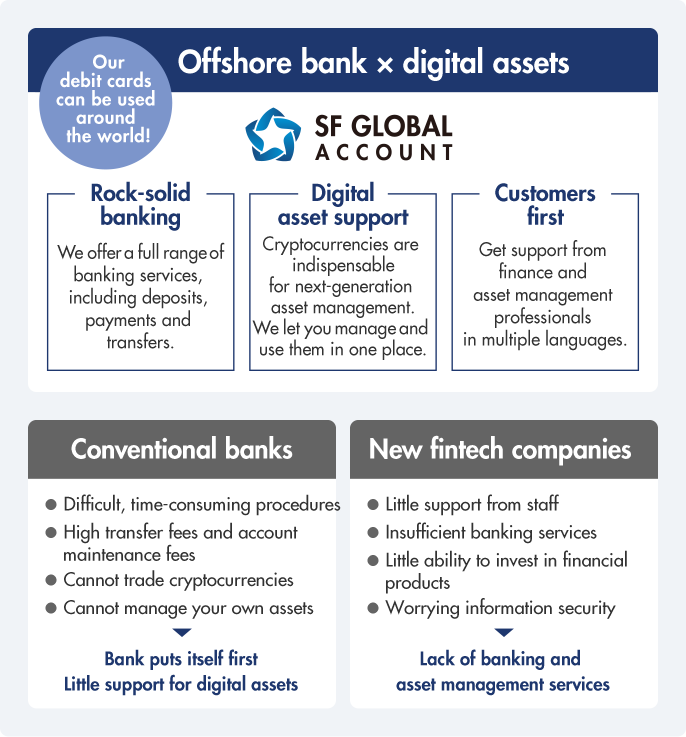

Effective structuring of your overseas company not just hinges on precise attention to organizational frameworks but also on leveraging innovation for cost savings. One way to utilize innovation for cost savings in offshore firm formation is by making use of cloud-based solutions for information storage space and collaboration. By integrating modern technology strategically right into your overseas business formation process, you can accomplish considerable financial savings while boosting operational effectiveness.

Decreasing Tax Obligations

Utilizing strategic tax obligation planning strategies can efficiently minimize the monetary worry of tax liabilities for offshore business. In addition, taking advantage of tax obligation rewards and exemptions used by the jurisdiction where the offshore business is registered can result in substantial cost savings.

An additional method to decreasing tax obligation liabilities is by structuring the offshore firm in a tax-efficient way - offshore company formation. This includes thoroughly creating the ownership and functional structure to optimize tax additional info advantages. Setting up a holding business in a territory with favorable tax obligation regulations can assist reduce and consolidate profits tax direct exposure.

Furthermore, remaining updated on global tax laws and conformity needs is important for decreasing tax liabilities. By making certain strict adherence to tax regulations and regulations, offshore firms can avoid costly fines and tax conflicts. Seeking specialist recommendations from tax experts or lawful specialists focused on global tax official site matters can additionally offer important understandings right into efficient tax obligation preparation strategies.

Guaranteeing Compliance and Risk Mitigation

Applying durable compliance procedures is vital for offshore business to minimize dangers and keep regulatory adherence. To make sure compliance and mitigate threats, offshore companies need to carry out comprehensive due persistance on customers and service companions to protect against involvement in illegal activities.

Moreover, remaining abreast of altering policies and legal needs is important for offshore companies to adapt their conformity techniques appropriately. Engaging legal experts or conformity professionals can supply valuable support on navigating complex governing landscapes and ensuring adherence to worldwide criteria. By focusing on conformity and danger reduction, overseas business can boost transparency, construct depend on with stakeholders, and safeguard their procedures from potential lawful repercussions.

Verdict

Utilizing calculated tax obligation planning strategies can effectively decrease the economic worry of tax obligation liabilities for offshore companies. By distributing revenues to entities in low-tax jurisdictions, overseas firms can legitimately decrease their total tax obligations. Additionally, taking benefit of tax rewards and exceptions offered by the territory where the overseas company is signed up can result in considerable financial savings.

By making sure stringent adherence to tax laws and regulations, overseas companies can avoid costly fines and tax obligation disagreements.In final thought, cost-effective overseas business development needs cautious consideration of territory, efficient structuring, technology utilization, tax minimization, and compliance.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!